FCF yield = FCF per share / Market Value per share.It has been touted by some investors to be a better measure of company performance than earnings per share due to the emphasis on the cash flow statement over the income statement in this metric. LFCF = Net Income + D&A - Change in NWC - Net investment in operating capital Free Cash Flow yield (FCF yield)įCF yield is a financial solvency ratio of a company. The most common way to calculate the LFCF of a company is, Changes in NWC = Changes in net working capitalĮBIT, D&A and Taxes can be found in the income statement while changes in NWC and Capex can be found in the current & prior period's balance sheet.D&A = Depreciation and Amortisation expenses.EBIT = Earnings before Interest and Taxes,.

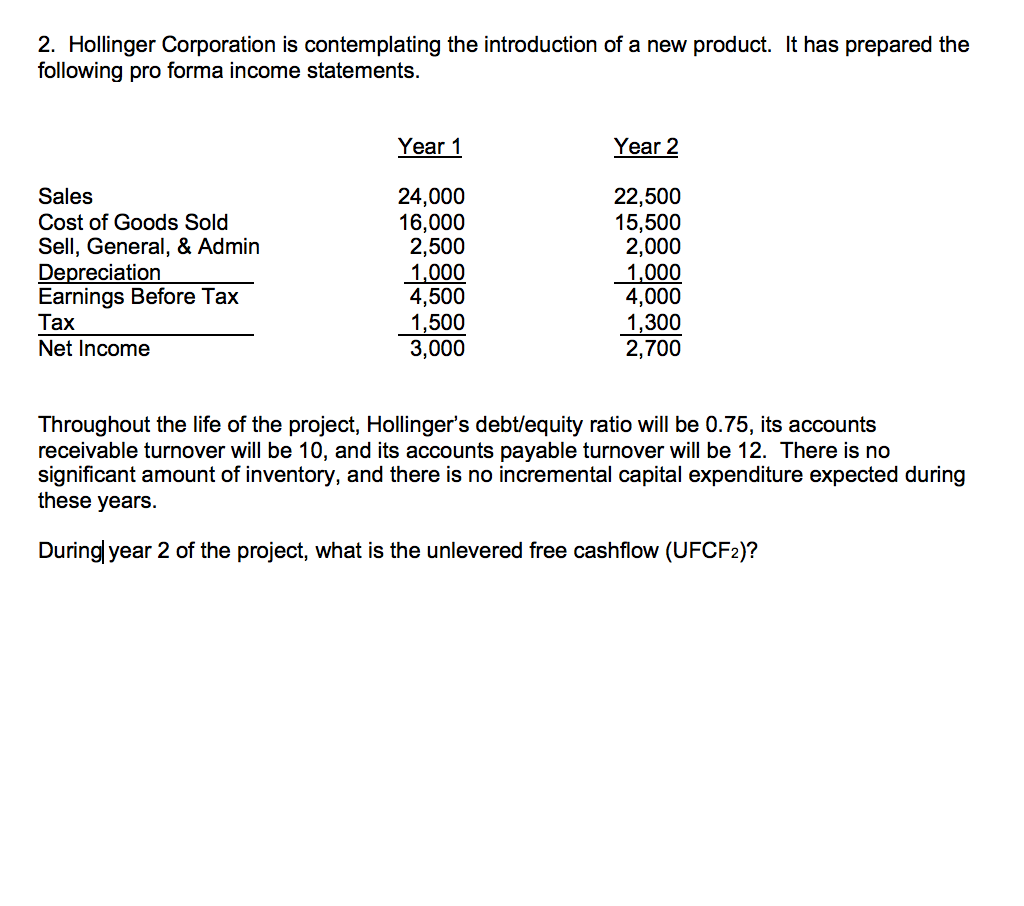

UFCF = EBIT * (1 - tax rate) + D&A - Change in NWC - Capex The most common way to calculate the UFCF of a company is as follow: These methods are related to one another and can be derived from the 3 statements ( income statement, balance sheet & cash flow statement). There are multiple methods to derive the FCF (UFCF & LFCF) of a company. This is because stock buyback is a more tax-efficient way of returning shareholder wealth compared to dividend payments. In the US stock market, stock buybacks have been the dominant way of returning shareholder wealth by a mile since the introduction of Rule 10B-18 in 1983 which legalized stock buybacks. Therefore, firms that retain FCF are likely firms that have a high return on investment (ROI) or unstable cash flows.Ī firm may pay out its FCF in two different ways, namely stock buybacks and dividend payments.

It is calculated by subtracting the cash used for Capital Expenditure (CapEx) and working capital requirements from Cash Flow from Operations ( CFO). Free cash flow ( FCF) is the cash flow a firm has remaining from its operating cash flows after accounting for its capital expenditure and working capital requirements.

0 kommentar(er)

0 kommentar(er)